What is Round-Tripping?

In the context of cryptocurrency trading, a round trip describes a situation familiar to many traders.

Imagine investing in a crypto asset, watching it skyrocket, only to hold on too long and see it plummet right back to your initial investment point or even lower.

It's a rollercoaster of emotions that many of us know too well.

Understanding the Basics of Round Tripping

Simply put, round tripping happens when:

Investment Entry: You start with a specific amount, say $50.

The Climb: The value of your investment rises, possibly tripling.

The Decline: Suddenly, market shifts cause the value to crash back to your starting point.

The Emotional Cycle: The hope of regaining lost ground often leads to holding longer than advisable.

Round tripping is most common among those trading with a short-term focus.

The Psychological Trap

It's important to recognize the emotional pitfalls associated with round tripping. Trading is not just about numbers; it's an emotional journey that can lead to quick decisions and potential losses.

Here are some considerations:

Fear of Missing Out (FOMO): Seeing others profit can create a sense of urgency.

Greed: A desire for higher profits can cloud better judgment.

Detaching emotions from trading decisions is crucial. I say it from personal experience, after spending years in the investment space and transitioning to active trading, I spend around four hours behind charts daily, aiming for objective decisions that hinge on market data and trends.

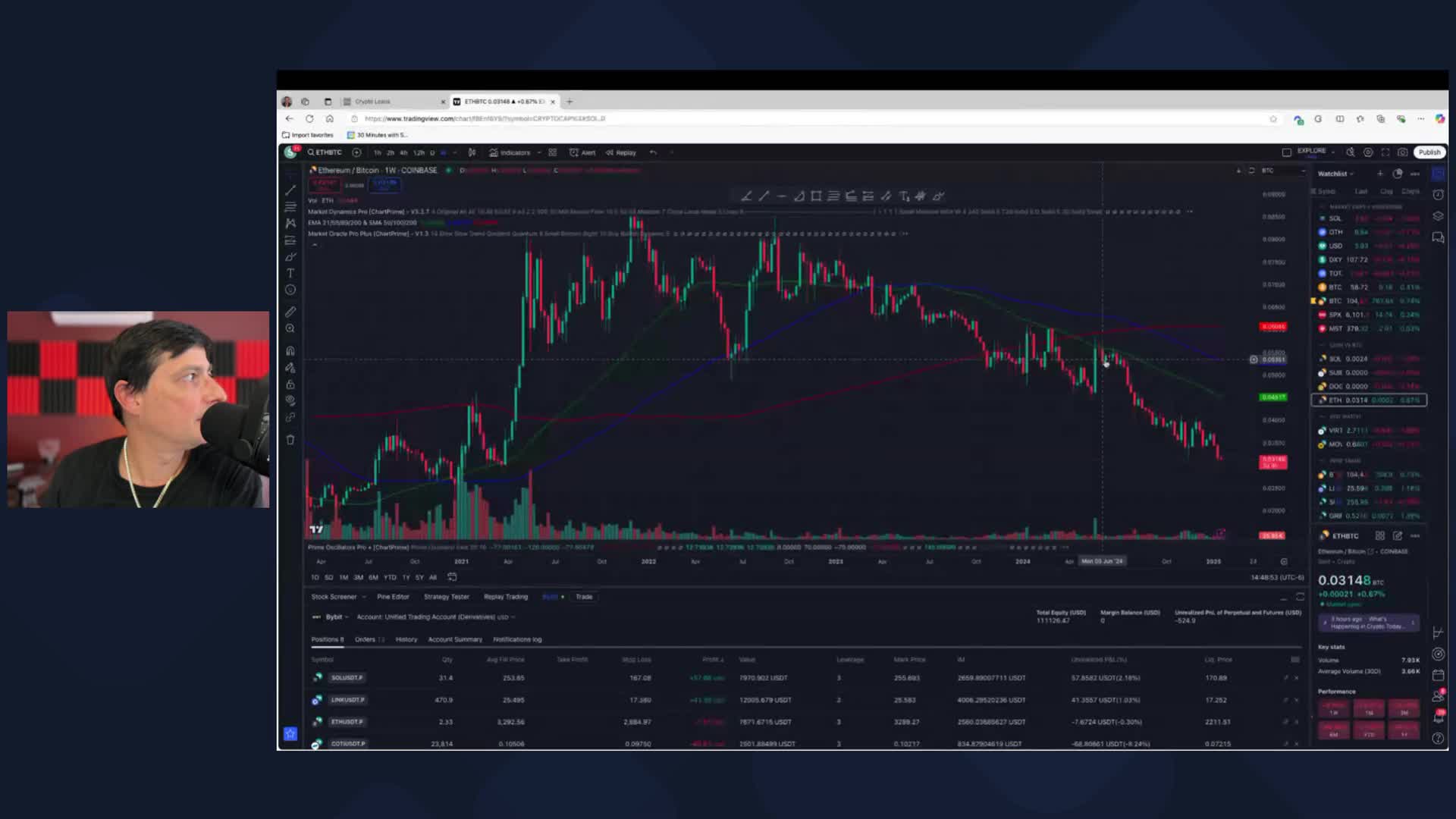

Market Dynamics and Current Economic Factors

Currently, we're witnessing a myriad of influences on the market, from political changes like those ushered in by leaders such as Trump to economic forums setting global financial trends.

In the recent economic summit, several statements and actions might have stirred uncertainty, affecting crypto's market behavior, creating what's known as market "choppiness"—a bumpy ride that can mislead the average trader.

Strategy for the Crypto-Investing Newbie

For those new to trading, it's advised to familiarize oneself with the market without rushing into risky trades. A popular entry strategy into the crypto world is dollar-cost averaging (DCA):

Commit to Consistency: Invest small, fixed amounts regularly.

Ignore Daily Pricing Fluctuations: Focus on long-term potential instead.

Why Bitcoin?

The resilience and evolving adoption of Bitcoin make it a strong candidate for new investors. Recently, companies and states increasingly recognize Bitcoin as an indispensable part of their asset portfolios.

Forecast for Bitcoin

I remain optimistic about Bitcoin reaching the $1 million mark within five to seven years, marking a potential tenfold increase from current levels. The widespread adoption plays a crucial role here with factors like:

Inclusion in major asset classes

The rise of related investment vehicles, such as ETFs

Advocacy by industry stalwarts like MicroStrategy's Michael Saylor

The Altcoin Perspective

As the crypto market matures, the "altcoin season" becomes an intriguing aspect for traders to explore. Typically following Bitcoin's massive run, this period sees alternative coins gain momentum.

Recognizing Altcoin Season

Historically, altcoin season begins as Ethereum and other coins outperform Bitcoin, offering faster gains for those adept in market timing.

Rand's analysis underscores potential shifts in this pattern due to institutional engagement primarily with Bitcoin, possibly delaying altcoin's usual emergence.

Educating New Entrants

I emphasize the importance of learning the ropes before diving headfirst into trading. Whether it's setting up wallets, identifying safe purchasing practices, or understanding fundamental trading strategies, education remains a vital tool.

Navigating the crypto world demands a blend of knowledge, patience, and emotional strength, and I encourage potential investors to consider the transformative role cryptocurrencies like Bitcoin could play in seizing control over financial freedom.

This is for informational purposes only and is not financial advice. Always do your own research and consult a professional before making any trading decisions.

For an in-depth look at these possibilities and to stay connected with cryptocurrency, join my mailing list at crypto.lifestyle.

Here's to a future where digital freedom meets meaningful change.